do nonprofits pay taxes on lottery winnings

Before you see a dollar of lottery winnings the IRS will take 25. The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members.

If you are sharing your winnings.

. Yes nonprofits must pay federal and state payroll taxes. Yes they have to pay tax on lottery winning. But if the Pool members were entitled to the.

The IRS takes 25 percent of lottery winnings from the start. Depending on the state you live in you may have to pay state and local taxes on lottery winnings in addition to federal taxes. Most states dont withhold taxes when the winner doesnt reside there.

Ad Find out what nonprofit tax credits you qualify for and other tax savings opportunities. However a nonresident of Wisconsin must have Wisconsin gross income including any Wisconsin lottery winnings of 2000 or more before the nonresident is required to file a. Get a personalized recommendation tailored to your state and industry.

Lottery winnings are subject to taxes but there are steps you can take to minimize the impact. Rather than an income. The IRS will usually require that the lottery company withhold taxes from your winnings before you even.

Phew that was easy. If youre a UK tax resident youre exempt from paying the following taxes on your lottery winnings. If your award is small enough you might be able to lower your tax liability by taking.

You might not realize it but if you win the lottery you wont be handed a check for the full amount. It is possible to donate to a non-profit organization that enables you to maximize some itemized deductions which could bring you into a lesser tax bracket. So even if you.

Do nonprofits pay payroll taxes. If you take its annuity value youll have to pay taxes every year. The amount deducted from your prize will depend on the state where your ticket was purchased and the.

Your recognition as a 501c3 organization exempts you from federal income tax. Although winning from lotteries is part of total income the same taxable at 30 Surcharge health and education cess as per. There are two winners at the same time with two lottery tickets worth VND 8000000 each ticket is smaller than the specified amount so there is no tax payableCase 2.

All winnings from the lottery are subject to tax but its not as simple as paying for it the year you won. You cannot legally avoid paying taxes on your lottery winnings. As soon as you have.

The key to avoiding income taxes is to give the ticket or an interest in the ticket to the charity before the drawing and before you are entitled to the winnings. Federal tax To begin with lottery agencies have to withhold 24 of. Right off the bat lottery agencies are required to withhold 24 from winnings of 5000 or more which goes to the federal government.

The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members. However just like American players youll be expected to pay taxes when you win. Ad Find out what nonprofit tax credits you qualify for and other tax savings opportunities.

FICA taxesSocial Security and Medicareare employment taxes. But depending on whether your. Get a personalized recommendation tailored to your state and industry.

In fact of the 43 states that participate in multistate lotteries only two withhold taxes from nonresidents. The simple answer is yes. Lottery winnings are exempt from FICA taxes because.

Up to an additional 13 could be withheld in state and local taxes depending on where you live. Theyre imposed on earned income so heres the good news. Section 671b of the Tax Law and Section 11-1771b of.

Monday Map State Local Taxes Fees On Wireless Service Online Lottery Lottery Infographic Map

Lottery Winners Should Start A Private Foundation No Really Vox

Woman Decides To Change Her Routine And Wins In Nc Lottery The State

How Much Can You Give To Charity Tax Free If You Win The Lottery

Lotteries Casinos Sports Betting And Other Types Of State Sanctioned Gambling Urban Institute

Tax Strategies For Lottery Winners

Taxes On 1 Billion Mega Millions Jackpot May Be More Than You Think

Win 1 Billion Mega Millions Lottery Jackpot Pay Mega Taxes

No Nevada Lottery Because Gaming Doesn T Want Competition Las Vegas Review Journal

Lotteries Casinos Sports Betting And Other Types Of State Sanctioned Gambling Urban Institute

All You Need To Know About The Powerball Lottery Powerball Lotto Tickets Lottery

New Hampshire Powerball Winner Claims Prize Announces 100 000 Donation To Charity New Hampshire Lottery

How To Increase Your Odds Of Winning The Lottery Rockypointautoinsurance

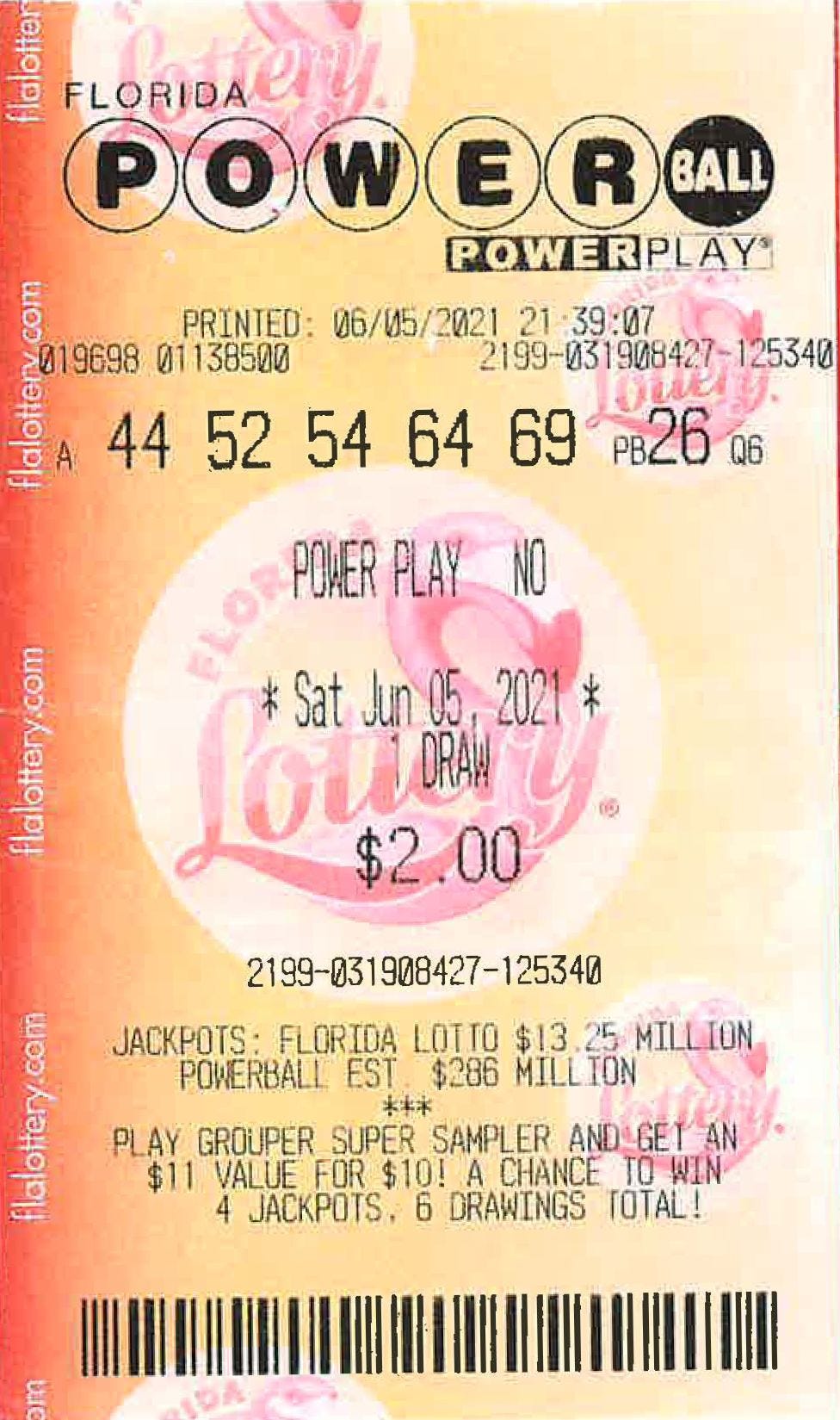

Trust Claims 286 Million Powerball Ticket Sold In Jacksonville

How Much Can You Give To Charity Tax Free If You Win The Lottery

Winner Of 1 28 Billion Lottery Gets 433 7 Million After Tax

You Won The Lottery Here S What You Should Do Now Gordon Fischer Law Firm